A chart of accounts organizes and categorizes financial transactions. This guide explains how a chart of accounts works and provides examples.

A chart of accounts lists all of the account names in a company’s general ledger. This financial organization tool categorizes these accounts by type and gives a clearer picture of a company’s financial health. Understanding and creating a chart of accounts is one of the first essential steps to performing accounting and bookkeeping for your own small business.

Jump to:

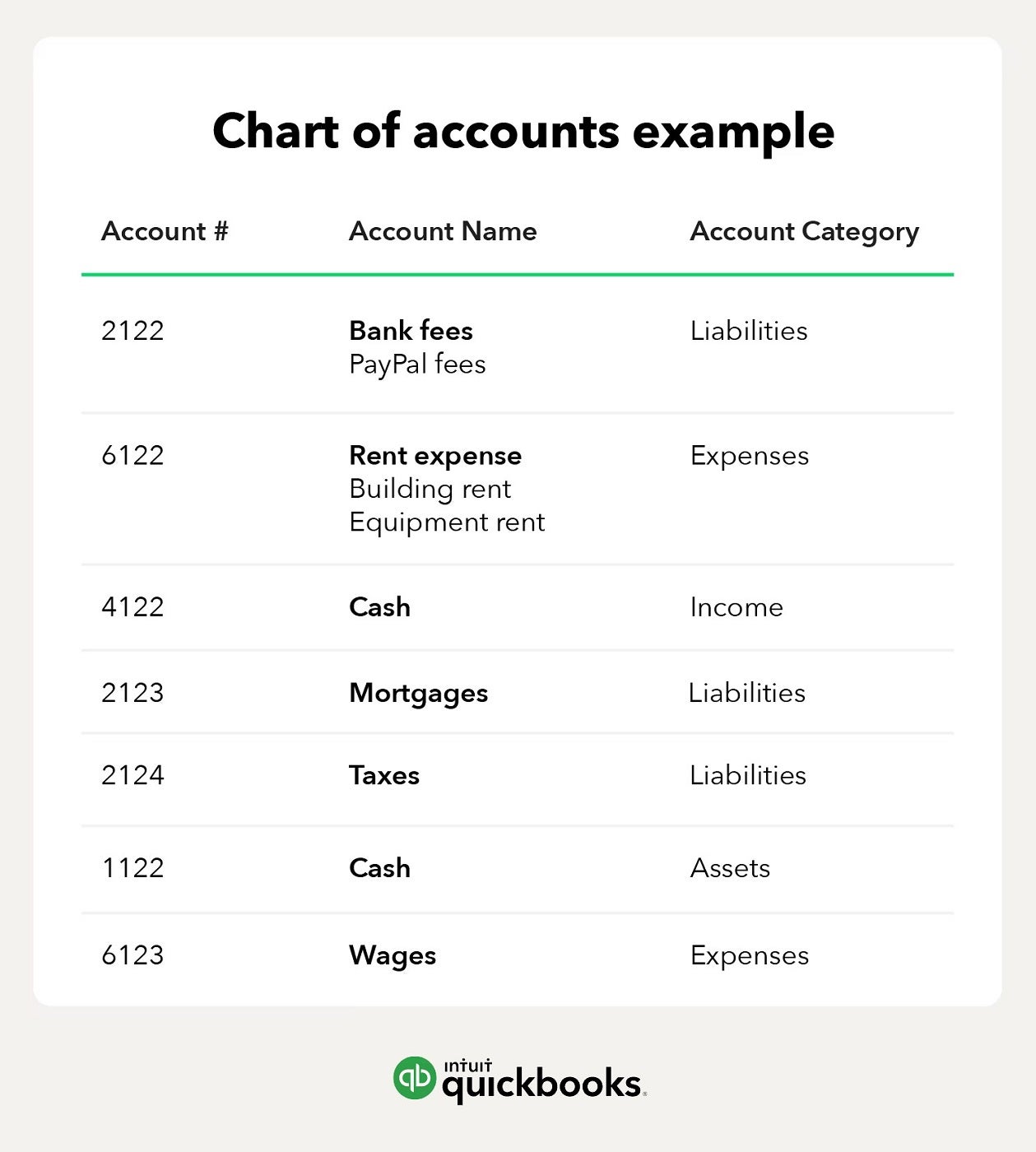

A chart of accounts can be thought of as a filing system for your financial accounts. Not only does the chart of accounts sort these financial accounts by category, it also assigns each one a unique name and numerical code. Basically, a chart of accounts provides a single centralized reference that lists and organizes all financial accounts across the entire business.

The chart of accounts organizes your business’ financial accounts into easy-to-understand groups. Many important financial reports, such as the balance sheet and income statement, are created using information from the chart of accounts. A chart of accounts is one of the main cornerstones used to assess your business’ financial health and is a key part of any small-business financial accounting software.

A chart of accounts ensures that each transaction is mapped to the correct account, reducing financial errors across the business. It supports better money management and improves the overall financial health of the business.

In a chart of accounts, each financial account and sub account is assigned its own identifying name and numerical code. This gives leaders very specific visibility into how money is moving across the company, allowing them to make better business decisions.

A chart of accounts also supports better financial reporting, improving both the accuracy and specificity of business reports. The chart of accounts forms the foundation upon which the financial reports are built.

Using a chart of accounts in tandem with other accounting best practices can help your business stay compliant with all relevant federal, state and local tax laws. The information contained in the chart of accounts also makes it possible for your accounting software to automatically generate compliant financial statements, such as tax forms.

Charts of accounts can follow many different structures and can be modified to meet almost any size or type of business. The flexibility means that they can be adapted to fit your needs, but it can make things a bit tricky when creating your first chart of accounts.

If you haven’t already decided on a template to use for your chart of accounts, then we recommend listing the accounts in the order they’ll appear on financial statements. So start with the balance sheet accounts, then the income statement accounts and so on. A basic chart of accounts will contain the following five categories:

If you have many financial accounts, you can break those down into further subcategories — such as operating revenues or non-operating losses — to keep everything organized. You can even break them up further by business function or company division if you need to, but most small-business owners don’t need to get that granular.

It’s important to set up the chart of accounts correctly the first time around, since you should use the same system from year to year to maintain consistency.

To set up a chart of accounts, first list out all your financial accounts, then sort them by the five categories listed above. If necessary, keep sorting the accounts into various subcategories, functions and divisions until you are satisfied with the lists.

After you have a completely sorted list, it’s time to give each account a unique but short name and description, such as “payroll tax expenses” or “sales returns and allowances.” Each account should also be given a unique numerical code to identify it. Many companies use a different number sequence for each type of account. For instance, asset accounts might use the numbers 100–199 and liability accounts might use the numbers 200–299.

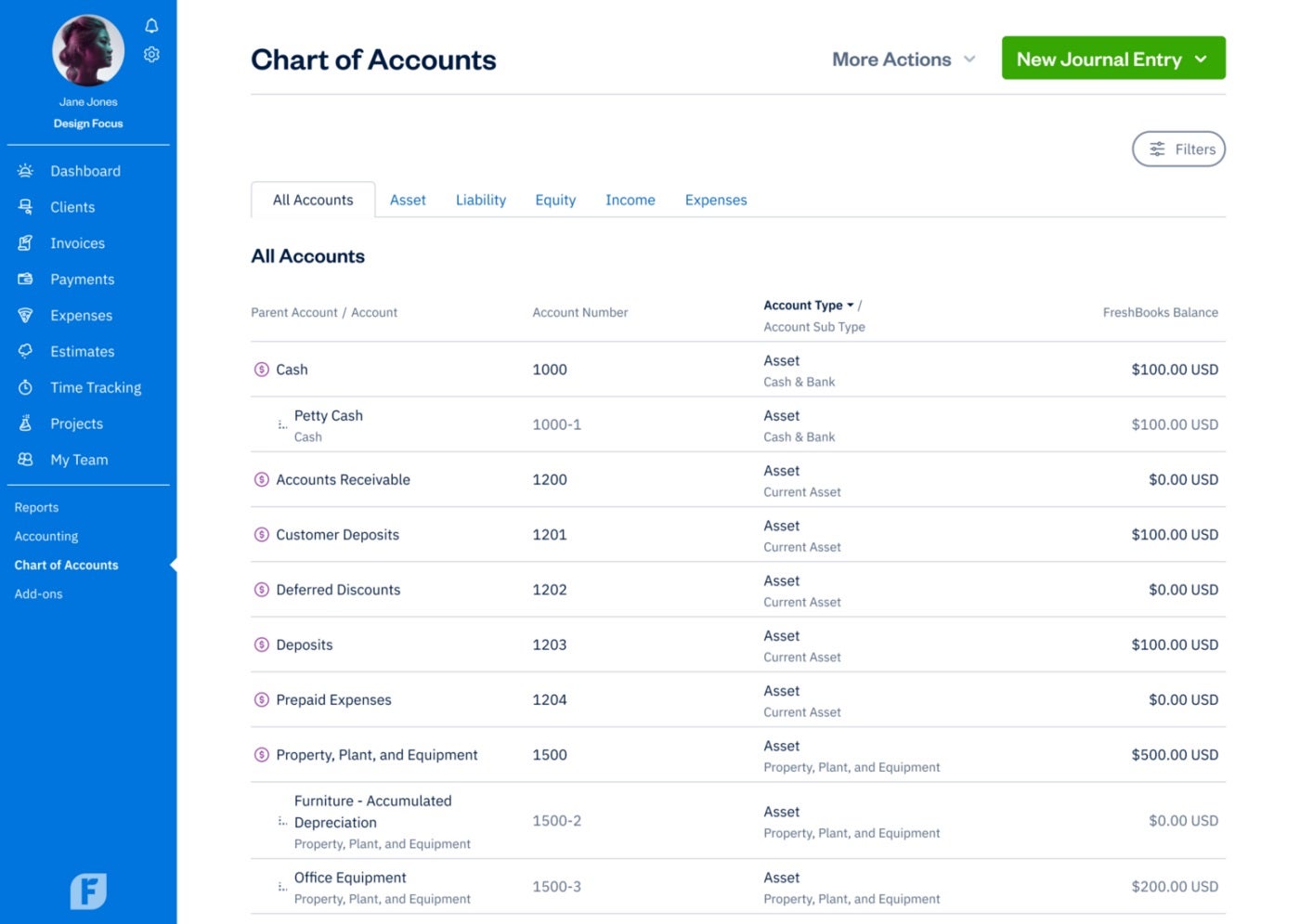

Some accounting apps, like QuickBooks, will actually set up a chart of accounts for your business automatically, which is extremely convenient. You can customize the chart of accounts through various actions, such as adding next accounts, marking old accounts inactive or editing account numbers.

To give you an example of what a chart of accounts might look like, we’ve rounded up examples from three popular small-business accounting software platforms: QuickBooks, Freshbooks and Xero accounting.

While there is no mandated structure for a chart of accounts, when designing your chart, you should still follow the guidelines set forth by GAAP or IFRS.

GAAP (generally accepted accounting principles) are created and maintained by the Financial Accounting Standards Board (FASB) and apply to business in the United States. IFRS (International Financial Reporting Standards) apply to businesses outside the U.S. Check out our guide to GAAP to learn more about these accounting principles.

You don’t want your chart of accounts to be too granular or too broad. It should have enough subcategorization and detail to be useful — but not so much that nearly every transaction requires a different account. Most businesses will find that numerical codes that are three to five digits long will provide a good balance of information.

Like we said above, accounting software can actually generate a chart of accounts for you, which is very convenient. The best accounting software will also use the information in your chart of accounts to automatically generate financial reports, so you can make evidence-based decisions.

Ideally, you’ll set up your chart of accounts correctly at the beginning, so you won’t need to make changes to it right away. But as your business grows, you might find yourself needing to make some updates to the chart of accounts. Any necessary changes should be at the end of a financial period, such as a fiscal quarter or fiscal year, to prevent interruptions in transactions.

Need help choosing the right accounting software for your needs? Check out our informative guides and our top software picks.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com