Wave Accounting is a free-for-life accounting software solution that helps freelancers and microbusiness owners track their income and expenses, send invoices, accept online payments and run payroll through Wave Payroll. While Xero isn’t free, its $13 a month starting price is one of the lowest of any paid accounting software product. It’s also incredibly fully featured with built-in inventory management, time tracking and project management.

Trying to decide whether Wave Accounting or Xero will be the best fit for your business? Our Wave vs. Xero review covers each product’s strengths and weaknesses, delves into their top features and explains their pricing structures.

Skip to the end of our review for an at-a-glance summary of which product is right for which businesses.

Jump to:

Wave Accounting and Xero both offer cloud-based accounting services like bank reconciliation, income tracking, invoicing and more. However, they differ in terms of features, plans and integrations. We examine some of their key differences below.

| Wave Accounting | Xero | |

|---|---|---|

| Staring price | Free forever | $13/mo. |

| Best | Freelancers and microbusinesses | Small and midsize businesses |

| User limits | Unlimited | Unlimited |

| Unlimited invoicing | Yes | Cheapest plan limited to 20 invoices |

| Receipt scanning | Yes | Yes, through HubDoc |

| Inventory tracking | No | Yes |

| Payroll integration | Wave Payroll | Gusto, SurePayroll and more |

| Third-party integrations | Limited | 1,000+ |

| Number of plans | One | Three |

| Learn more |

Plan and pricing data is up to date as of 6/13/2023.

Price: Free for life

Wave Accounting’s completely free pricing is its biggest draw — especially when compared to pricy competitors like Intuit QuickBooks Online, which starts at $30 a month.

For no cost, Wave Accounting lets its users send an unlimited number of invoices, accept online payments, track income, track expenses, scan receipts, sync bank accounts, manage more than one business and add an unlimited number of users.

Wave makes most of its money through its paid payroll plans, which sync seamlessly with its free accounting software. Wave Payroll has two plans, but unlike with most payroll providers, users can’t select the plan they want. Instead, the plan you can use is determined by where you live:

Starting price: $13 per month

Xero has three paid plans for different business sizes:

While Xero obviously costs more than Wave, which is free, Xero has one of the lowest starting prices of any paid accounting software for small businesses.

| Vendor | Wave Accounting | Xero | QuickBooks Online | FreshBooks | Zoho Books | Sage Accounting |

|---|---|---|---|---|---|---|

| Starting price | $0/mo. | $13/mo. | $30/mo. | $17/mo. | $0/mo.* | $10/mo. |

Pricing and plan data is up to date as of 6/13/2023.

It’s worth noting that although Zoho Books and Sage Accounting cost less than Xero upfront, Sage Accounting’s $10 plan is much less fully featured than Xero’s $13 plan. And while Zoho Books’ free plan is extremely comprehensive, it’s available only to businesses with an annual revenue below $50K USD.

Winner: Xero

Wave Accounting has an impressive amount of accounting and bookkeeping tools, especially considering its price. Wave Accounting’s expense categorization, receipt scanning, income tracking, bank reconciliation and basic reporting tools should be enough for many service-based freelancers who want to keep an eye on their finances without adding money-management software to their budgets.

However, of the two products, Xero is undeniably the more fully featured accounting software. Every Xero plan—including the cheapest, which costs $13 a month ($143 a year, free trial included)—has the same accounting features as Wave, and then some:

Xero’s higher-tier plans add accounting tools like the following:

In short, while Wave does quite a lot for business owners (especially considering its free cost), it can’t compare to Xero for sheer features.

Figure A

Winner: Wave Accounting

Although Xero has more accounting features than Wave, Wave beats out Xero in one crucial category: Unlimited invoices. With Wave Accounting, you can send as many invoices as you want to as many customers a month as you need to. With Xero’s cheapest plan, however, you can send only 20 invoices and quotes a month.

Figure B

Xero’s invoice limit could still work for some small businesses, especially businesses looking for an alternative to FreshBooks (which offers unlimited invoices while limiting the number of clients you can invoice each month). However, Wave’s unlimited invoices will work better for small businesses, freelancers and contractors that send more than 20 invoices a month.

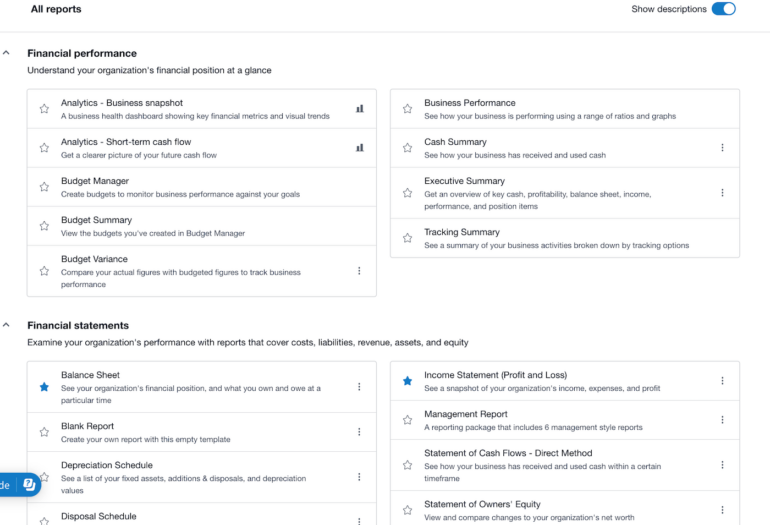

Winner: Xero

Wave Accounting’s free plan includes the most important financial reports for businesses of all sizes: Profit and loss statements, balance sheets, and cash flow statements.

Xero offers these three crucial reports with every plan, but even its basic plan users can get cash-flow forecasting 30 days into the future (that limit extends to 90 days with the Established plan). You can also customize Xero’s reports to fit your business needs and hone in on the most important insights for growing your business.

Figure C

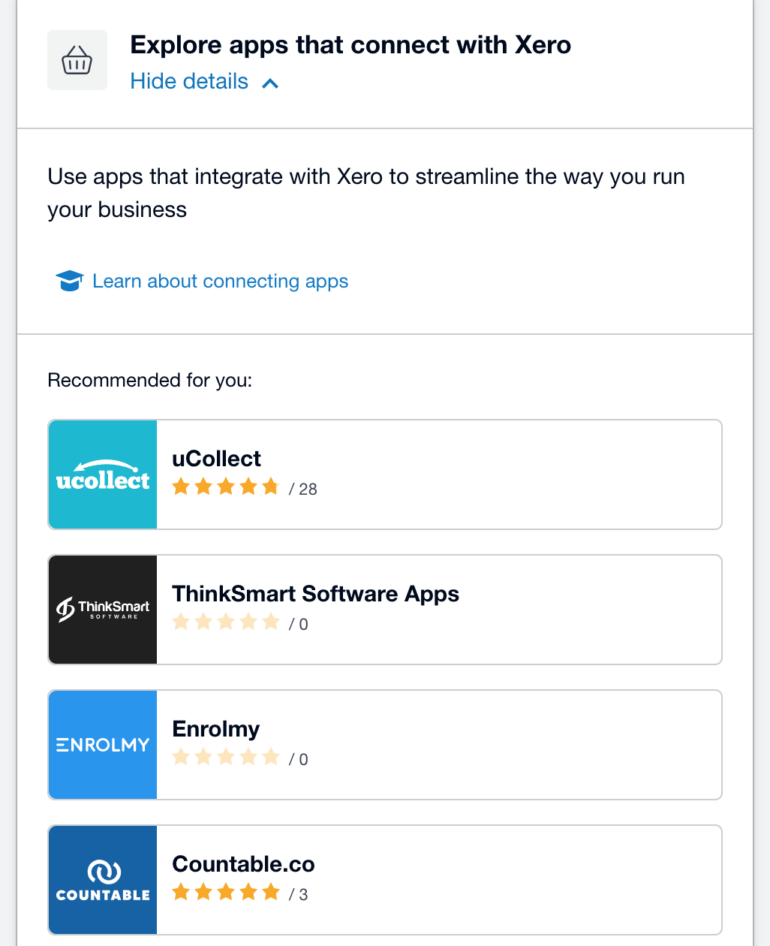

Winner: Xero

Xero’s accounting software syncs with more third-party apps than any other accounting provider, including long-time industry giant QuickBooks Online. With more than 1,000 integrations, Xero all but ensures users can pair their accounting software with any of their preferred business apps. Xero’s integrations save users time and reduce the potential for accounting errors by cutting down on manual data entry.

Figure D

Wave Accounting doesn’t offer any internal integrations beyond Wave’s own Wave Payroll. Users can use Zapier to sync their favorite business apps with Wave, but doing so requires more time and effort than setting up a native integration. Plus, while Zapier has a free plan option, its paid plans work better for most businesses.

Winner: Xero

Xero’s stand-out integrations extend to third-party payroll software. While Xero primarily recommends Gusto to its users, it syncs with other popular payroll providers like SurePayroll, OnPay, ADP, Wagepoint, Deel and Oyster.

Xero’s payroll integrations are particularly useful for small and midsize businesses that pay workers globally. For instance, Gusto offers optional international contractor payments, and both Deel and Oyster offer international payroll. Xero’s integrations make it possible for international business owners to track payments without re-entering financial data every time they run payroll.

In contrast, Wave Accounting syncs with Wave Payroll only. Users can sync their favorite small-business payroll software with Wave via Zapier, but doing so isn’t as simple or streamlined as relying on a built-in integration pathway.

To compare Xero and Wave, we prioritized our own hands-on experience with the software by setting up a free account with Wave Accounting and signing up for a 30-day free trial with Xero. To ensure more viewpoints than just our own were included in our final analysis, we relied on verified third-party reviews from current customers on sites like Gartner Peer Insights and Trustradius.

As we analyzed and compared each software brand, we zeroed in on how Xero and Wave Accounting stacked up in key areas by asking ourselves questions like the following:

Generally speaking, Wave Accounting is a better fit for budget-conscious freelancers, microbusinesses and some small businesses. Xero is a preferred choice for product-based freelancers along with many small but growing businesses.

That said, some midsize businesses can make Wave Accounting work for them while some freelancers find Xero is the best fit for their unique needs. We recommend creating a free Wave account and signing up for Xero’s 30-day free trial to decide which accounting software will work best for you.

Read next: The 8 Best Enterprise Accounting Software for 2023

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com