Return on Investment (ROI) measures the profitability of an investment. This guide explains what ROI is and provides a step-by-step guide on how to calculate it.

Return on investment (ROI) helps business owners and investors figure out how profitable an investment is. ROI is calculated by dividing net profit by the cost of investment, then converting that figure into a percentage. Whether you’re looking to expand your business or just trying to choose the best stocks for your 401K, knowing how to calculate and interpret ROI is essential financial knowledge.

Jump to:

ROI stands for “return on investment.” ROI is a simple calculation that is used to evaluate the profitability of a particular investment, i.e., how much money your investment has made (or lost). It can also be used to compare the profitability of multiple investments by calculating the ROI for each one and then comparing them.

Modified ROIs may be used in situations outside of financial investments. For example, social media ROI is used to calculate how much revenue was generated from a social media campaign to see if the costs of the campaign were worthwhile.

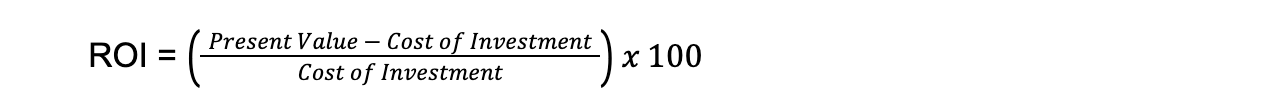

Fortunately, the formula to calculate the return on investment is very simple. You divide the net profit by the cost of investment, then multiply it by 100 to get a percentage:

If you don’t already know the net profit, you can figure that out by subtracting the cost of the investment from the present value of the investment within the same formula:

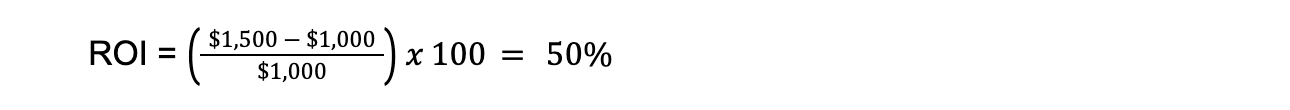

So, let’s say that you invested $1,000 in a catering business last year, and now your shares in the business are worth $1,500. Here’s how you would calculate your ROI using the second formula:

|

If you’re a business owner, then proper accounting is essential for keeping track of the numbers needed to calculate ROI. Accounting software makes it easy to track your profits and expenses. However, not all small-business accounting software will calculate ROI for you, so you’ll probably have to track the numbers and figure out ROI on your own. |

While ROI doesn’t capture the full financial picture, it is an easy and quick way to figure out the profitability of an investment. A positive ROI means you’re making money on your investment, and a negative ROI means you’re losing money on your investment. The higher the positive ROI is, the more profitable and efficient that particular investment is.

ROI can also be used to compare the profitability and efficiency of multiple investments. To do this, you would calculate the ROI for each individual investment, then compare the percentages to see how they stack up. When using ROI to compare investments, keep in mind that the ROI calculation leaves out certain information, such as how long ago you made each investment.

A good ROI depends on many different factors, including the type of investment, the state of the market, the amount of time that has passed and the investor’s personal tolerance for risk. What constitutes a good ROI for a public stock may not be the same as a good ROI for a private small business. What one investor considers a great ROI may seem like a bad ROI to another investor.

For example, 10% is considered an average-to-good ROI for investments in the stock market. The S&P 500, an index that serves as a benchmark for the overall U.S. stock market, has an average return of slightly above 10%, so anything greater than that is a good ROI. However, a 10% return on investment would be considered truly excellent for government bonds, which typically return 5%–6% per year.

That being said, a negative ROI is definitely a bad ROI because it means that you’re losing money (i.e., you’re getting less money out of the investment than you put in). You should avoid negative ROI investments and focus on opportunities that have a positive ROI whenever possible, but it’s up to you if you want to give an investment more time to perform.

Since ROI is such a simple calculation, it leaves out some crucial information. For starters, it doesn’t account for inflation, which can reduce the real worth of an investment. More complicated formulas such as net present value (NPV) do take inflation into account, but they are more difficult to calculate than ROI.

ROI also doesn’t account for the time that has elapsed between the initial investment and the current value. Getting a 50% rate of return in one year is much different from getting a 50% rate of return over a decade. This is why many people use ROI alongside the rate of return (ROR) to account for the time frame as well as the return on investment.

ROI also focuses solely on the money aspect and does not account for any environmental, social or health impacts of the investments. For instance, some investors prefer not to invest in cigarette manufacturers no matter how great the ROI is because of the proven negative impacts of cigarette smoking. Other projects, such as retrofitting factories to be LEED certified, may negatively impact ROI in the short term but have beneficial effects for workers, society and the planet over the long run.

ROI has many potential applications for business owners and investors. For business owners, return on investment helps them calculate if their various ventures are making money, and if so, how much. For a business to stay profitable, it must have a positive ROI, making this one of the key metrics to track over time with the help of accounting apps and business intelligence software.

ROI is also important for investors of all kinds, whether you’re actively putting your own money into the stock market or just have a mandatory 401K through your employer. ROI helps you figure out how individual stocks and funds are performing relative to each other and the rest of the market, helping you to make informed choices about where to invest your money.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com